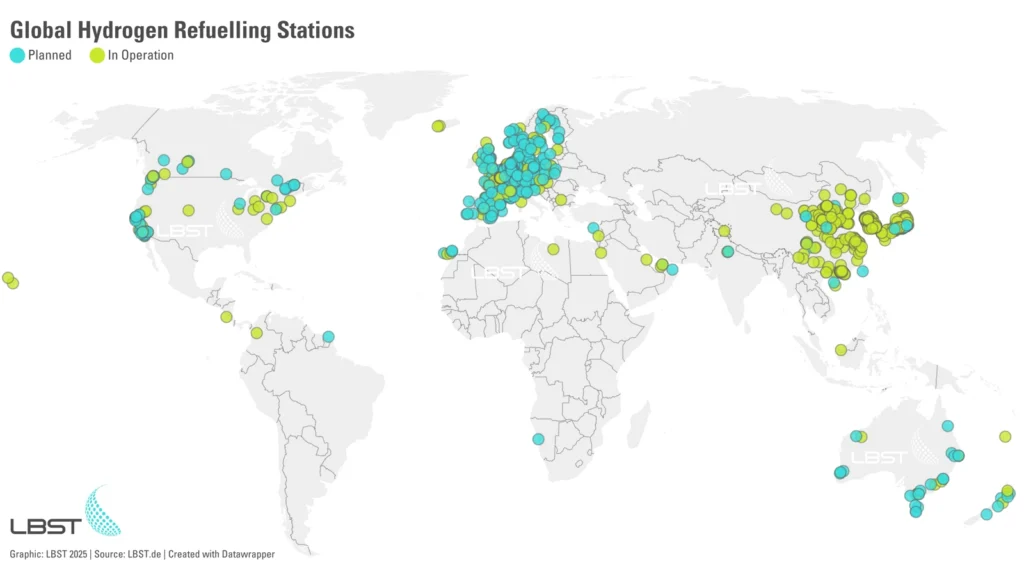

New report: There are now 1,000+ hydrogen refuelling stations and counting

It might feel like the hydrogen conversation has been building for ages, but 2024 was a real turning point.

According to the latest figures from LBST’s H2stations.org report, the number of operational hydrogen refuelling stations worldwide has officially crossed the 1,000 mark.

Specifically, by the end of 2024, around 1,160 stations were up and running – an impressive milestone for an industry once viewed as the distant future of clean mobility.

Where the growth is happening

Asia

Asia leads by a wide margin, boasting 748 active stations.

China accounts for the largest share at 384, followed by South Korea with 198 and Japan at 161.

Notably, South Korea added 25 stations – its third consecutive year at that pace – reinforcing its position as a major hydrogen hub.

Europe

Europe saw its station count rise to 294, with Germany at 113 and France at 65.

The Netherlands reached 25 stations, while Bulgaria and Slovakia each opened their very first stations in their capitals.

Find your nearest hydrogen filling station in Europe.

North America

North America added 13 new stations in 2024 (4 in Canada and 9 in the U.S.).

However, the U.S. lost 12 older stations, bringing its operational total down to 89 – most of these in California.

Find your nearest hydrogen filling station in the U.S and Canada.

New Zealand

New Zealand joined the growing list of hydrogen-active nations, installing its first-ever station.

Global

In total, 45 countries now have either operational stations or ones under construction, with 125 new sites added globally last year alone.

Outside of China, there are already 377 more stations in the planning pipeline, indicating strong industry confidence in hydrogen’s role in clean transportation.

Challenges and opportunities

One caveat worth noting is data accuracy – closures aren’t always widely publicised, so precise station counts can be tricky to confirm.

The takeaway, though, is clear: despite a few closures, hydrogen refuelling infrastructure continues to expand.

Each new station not only makes hydrogen vehicles more practical, it also incentivises further investment from automakers and governments eager to reduce emissions.

Fiscal support and regulatory mandates

Though industry enthusiasm is clear, it’s the legislation and funding frameworks that often propel real-world progress.

In Europe, the EU’s alternative drives mandate – a component of broader regulations on clean mobility – encourages member states to ramp up infrastructure for zero-emission fuels, including hydrogen.

This goes hand in hand with targeted subsidies, grants, and incentives aimed at both public and private sectors.

The goal is not just to boost station numbers, but to build a fully integrated hydrogen economy that covers everything from passenger cars to heavy-duty transport.

Meanwhile, the UK ZEV (Zero Emission Vehicle) mandate sets binding targets for automakers to sell a minimum percentage of zero-emission vehicles each year.

While battery electric cars often steal the headlines, hydrogen fuel cell vehicles are increasingly part of this push.

Financial support – like tax breaks for fleet operators and direct funding for station construction – further reinforces the case for hydrogen in the UK’s decarbonisation plan.

By tying regulatory targets to economic incentives, policymakers are effectively bridging the gap between today’s infrastructure and tomorrow’s clean-transport goals.

From Europe’s steady rollout to Asia’s sizeable push and North America’s ongoing developments, the momentum is unmistakable.

If the current trajectory continues, hydrogen’s role in the global transport mix will only grow stronger in the years ahead.