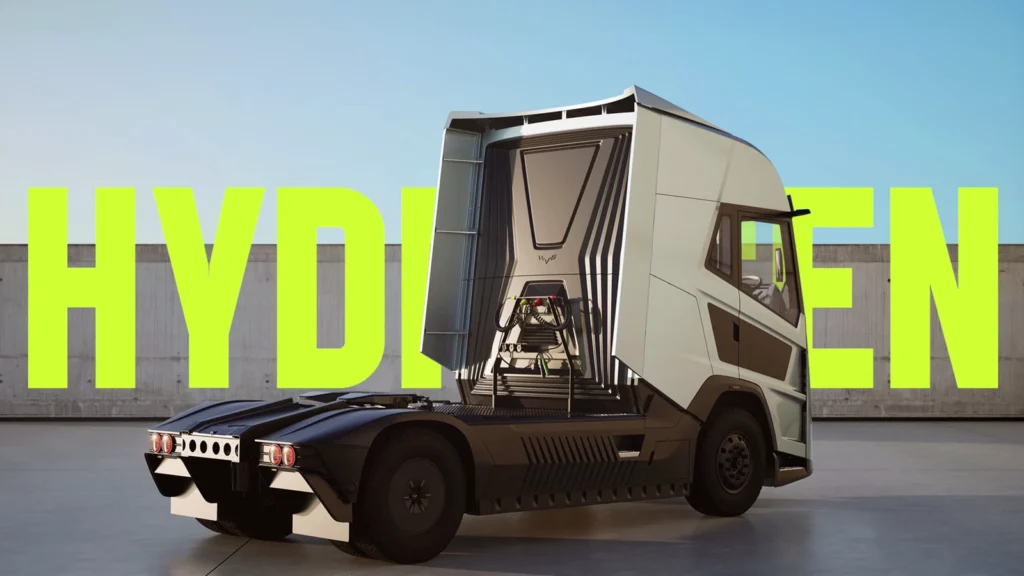

Hydrogen Vehicle Systems (HVS) secures fresh investment amid staffing shakeup

Glasgow-based Hydrogen Vehicle Systems (HVS), one of the leading developers of hydrogen-powered commercial vehicles, has received new investment from Qatar’s Excelledia Ventures.

This new funding comes in the wake of recent operational challenges, including layoffs in October, as the company sought additional capital.

New backing from Excelledia Ventures

This new cash injection is funded by Excelledia Ventures, a Qatar-based firm known for AI-driven enterprise management solutions.

Specific financial terms of the deal were not disclosed, but HVS’s press release suggests this backing could assist the company in both accelerating its truck development and potentially unlocking further international climate-tech funding.

Excelledia Ventures has prior collaborations with global organisations, including Nestlé, BP, and the Qatar Ministry of Foreign Affairs, and maintains a focus on harnessing AI to drive efficiency.

Their commitment to HVS ties in with the Middle East’s increasing investments in clean energy and aligns with Qatar’s active support of climate-focused initiatives.

Muhamed Farooque, CEO of Excelledia Ventures, said: “We specialise in AI software that optimises business performance. Immediately we saw the potential in HVS’s AI innovations – it’s essentially the same transformative technology we use applied to the trucking industry.”

Abdul Waheed, CEO of HVS said: “We are delighted to announce this latest investment in HVS. Excelledia Ventures’ support enhances our eligibility for the £1 billion Qatar-UK Climate Tech Fund, thanks to Excelledia’s strong relationships with key stakeholders such as Qatar’s Transport Authority and Qatar Investment Authority.

“Thanks to its resources and expertise, the Middle East is also uniquely positioned to lead the global hydrogen charge and is already making significant progress.”

Opinion

One might deduce from these remarks that Excelledia Ventures’ core interest may lie primarily in HVS’s proprietary AI technology, rather than solely in the potential for a hydrogen truck fleet.

Given Excelledia’s background in AI solutions, the synergy with HVS’s emissions-optimisation software could prove a central factor in the partnership.

HVS challenges

In November 2024, Motor Transport reported that HVS had cut back its workforce after failing to raise sufficient funds. According to the article, multiple employees received termination notices on 17 October, with their final employment date set for 31 October.

Some former employees told Motor Transport they were informed the layoffs were a result of the company not meeting its funding targets.

Only a portion of HVS’s board and core engineering team remained in place after the cuts, enabling the company to continue minimal operations while pursuing new investment.

Managing director Ian Palmer left the company in October with Companies House records confirming his directorship ended on 21 October.

Despite the staff reductions, HVS has consistently reiterated – through its press statements and other public materials – that it aims to stay on course to commercialise its hydrogen truck technology.

Ongoing projects and future milestones

Despite recent challenges, HVS has pursued several projects and secured government grants to advance its hydrogen technology:

- Prototype manufacturing: In April 2024, HVS began constructing truck prototypes at a facility in Silverstone, Northamptonshire. These prototypes will inform the next stage of testing and development.

- Public funding: The company has received approximately £15 million in grants for zero-emission research, as well as additional support for the development of a hydrogen-powered ambulance.

- Planned trials: Operators such as Explore Plant & Transport Solutions and White Logistics are slated to trial HVS trucks, aiming to assess real-world performance and viability for day-to-day logistics.

The newly secured investment from Excelledia may also position HVS for potential funding from the £1 billion Qatar-UK Climate Tech Fund, given Excelledia’s connections within Qatar’s public and private sectors.

The future for HVS

HVS has publicly discussed a roadmap that includes a possible NASDAQ listing as early as 2027. According to the company, external market analyses and IP valuations would support such a move, helping HVS attract additional capital.

For now, it seems that the focus remains on solidifying its financial footing and preparing for vehicle trials.

If the partnership with Excelledia Ventures helps HVS bring its hydrogen truck prototypes closer to production, the company could still emerge as a key player in the push toward zero-emission commercial transport – a sector widely recognised for its substantial decarbonisation potential.